Is Brandon Johnson's head tax already dead?

Chicago Mayor Brandon Johnson has pitched several major tax increases since his election in 2023.

Remember “Bring Chicago Home,” the plan to triple the transfer tax on all real estate sales over $1 million? Or the $300 million property tax hike he proposed after pledging not to hike property taxes?

But all of Johnson’s big new revenue proposals to date have something in common: None have passed. And his much-maligned $21-per-employee monthly head tax appears doomed to the same fate.

After we scooped the details of Johnson’s head tax, there has been a torrent of new opposition—and no new, prominent support—for this proposal.

That’s in no small part thanks to The Last Ward readers who contacted their City Council members last week. Thank you.

Let’s get into the latest.

Dead on arrival

Johnson introduced his head tax proposal in a city where hiring expectations just hit a five-year low, economic growth is slower than all peer cities, and businesses already pay the highest commercial property taxes among the top 10 cities in the country.

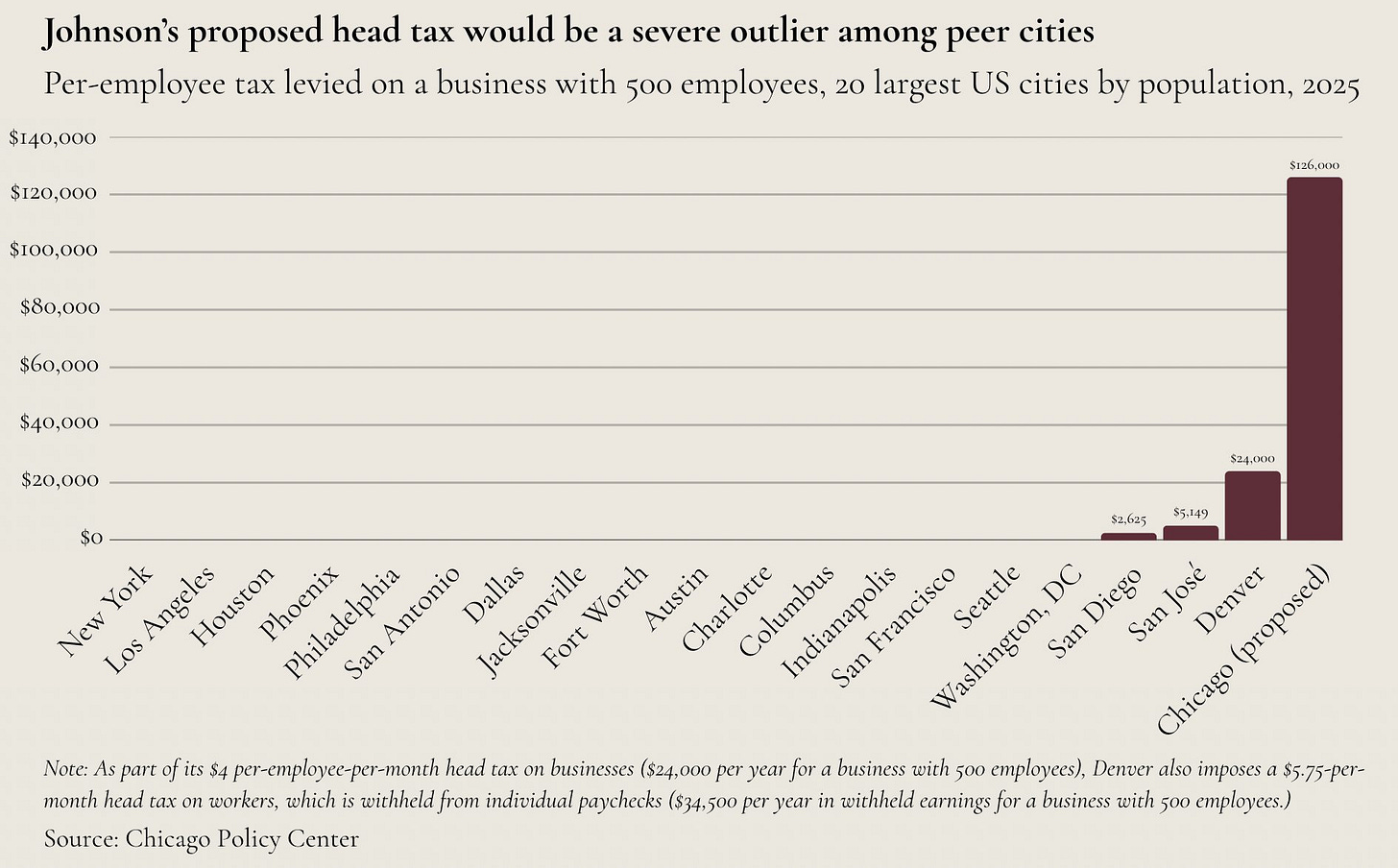

Further, no other big city charges anything close to what Johnson is proposing. Only four of the 20 largest cities in the country charge any kind of tax based on the number of employees a business hires.

Chicago’s tax would be five times higher than Denver’s, which currently stands as the highest head tax in the country. And while Johnson’s team has been pushing the Denver example with City Council members, they’re ignoring a key difference in Denver’s head tax: it hits employees directly.

Denver charges a $4 per-employee-per-month head tax on businesses, compared to Johnson’s proposed $21, but it also hits every employee of that business with a $5.75-per-month tax that’s withheld directly from their paychecks.

So what’s happened since Johnson floated this idea?

First, Illinois Gov. JB Pritzker came out “foursquare opposed” to a head tax.

Then, Johnson appeared to be caught off-guard by a simple question from Crain’s Chicago Business reporter Justin Laurence: Did the mayor’s team account for employees working remotely, who would not be subject to the head tax, when they calculated their $100 million revenue estimate?

Johnson couldn’t answer and deferred to Budget Director Annette Guzman. Her answer made clear that his team had not, in fact, considered remote work in creating the revenue estimate.

This earned a deserving rebuke from the Chicago Tribune editorial board.

In the same press conference, Johnson said those opposed to his head tax “are not wanting to help domestic violence survivors” and “should do some real soul-searching.”

Just two days later, 27 of 50 Chicago City Council members signed a letter opposing the head tax. (See if your alderman signed on here.) As the Chicago Tribune’s Alice Yin noted, four of the signatories voted yes on Johnson’s last budget, and one was a Johnson appointee.

Finally, Illinois House Speaker Chris Welch, D-Westchester, voiced his opposition Friday on The Fran Spielman Show.

“Chris Welch does not support a head tax. I don’t think that’s good policy for the city of Chicago,” he said. “I do think a head tax, and I agree with the governor on that one, is probably not one of the best ideas.”

Welch’s remarks were followed by a piece from the Wall Street Journal editorial board opposing the tax, marking its first national media attention.

There have been rumors that progressive City Council members are discussing the introduction of an even higher head tax proposal: $40 per employee per month, or more.

Given this tax’s trajectory, that would almost certainly end in further embarrassment for the mayor.

A better alternative

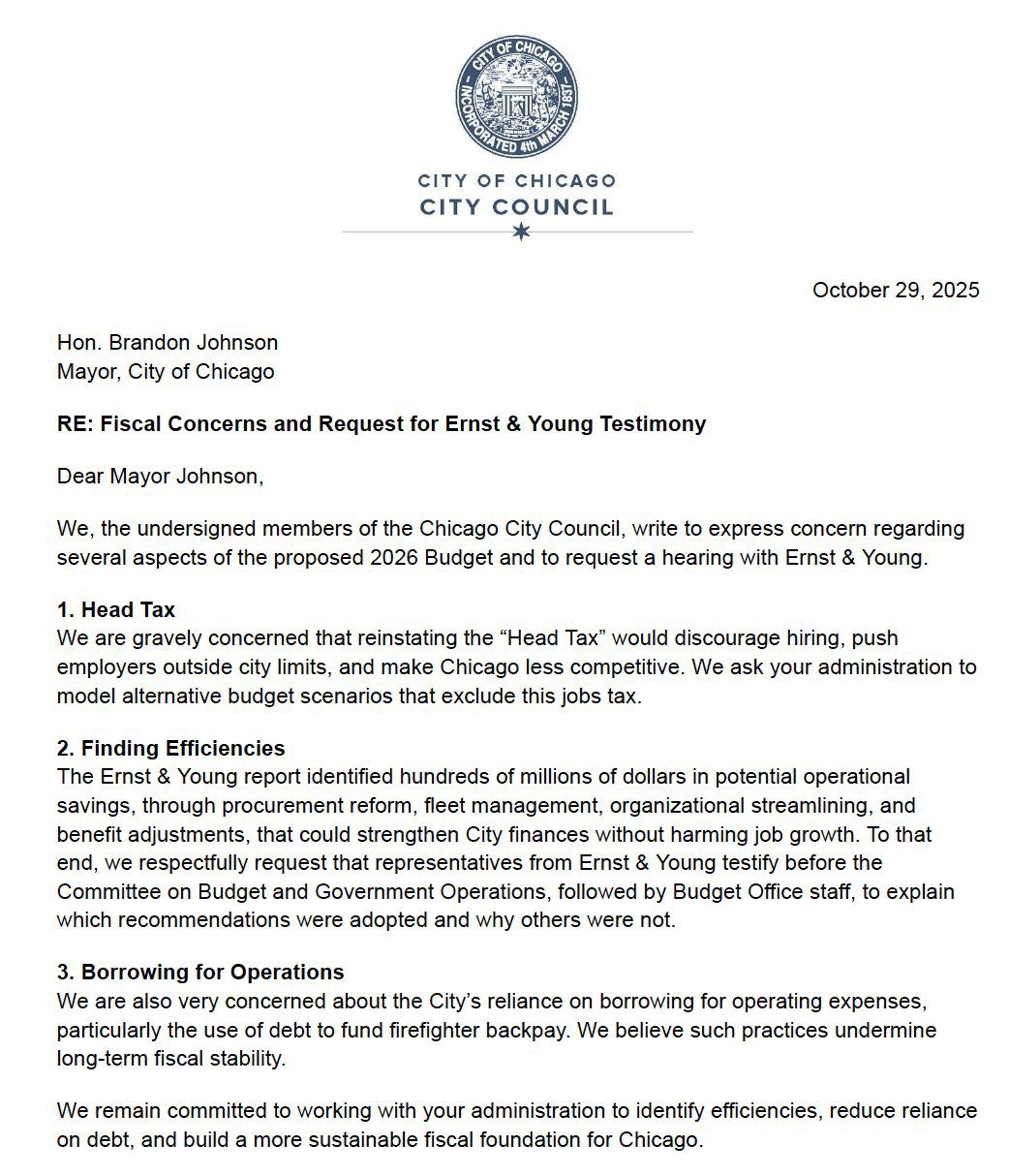

The letter signed by 27 aldermen is among the most encouraging examples of Council independence in recent years.

Not only does it tell the mayor “no” to a head tax, it also demands the mayor seek realistic alternatives. Those alternatives reside in a recent Ernst & Young report on potential efficiencies. Here are just a few commonsense ideas from that report:

Asking city employees to pay the same for their benefits as their public-sector peers in cities like Houston, Los Angeles, and New York. (Savings: $80M-$103M)

Consolidating overlapping departments, streamlining hiring and administration, and expanding automation and in-house legal capacity to boost efficiency. (Savings: $147.5M–$257.2M)

Modernizing procurement through citywide category management, consolidating vendor contracts, and leveraging bulk purchasing power to cut waste, improve transparency, and prevent fraud. (Savings: $55M–$111M)

Kudos to the letters’ signatories for calling on the report’s authors to testify.

In the news

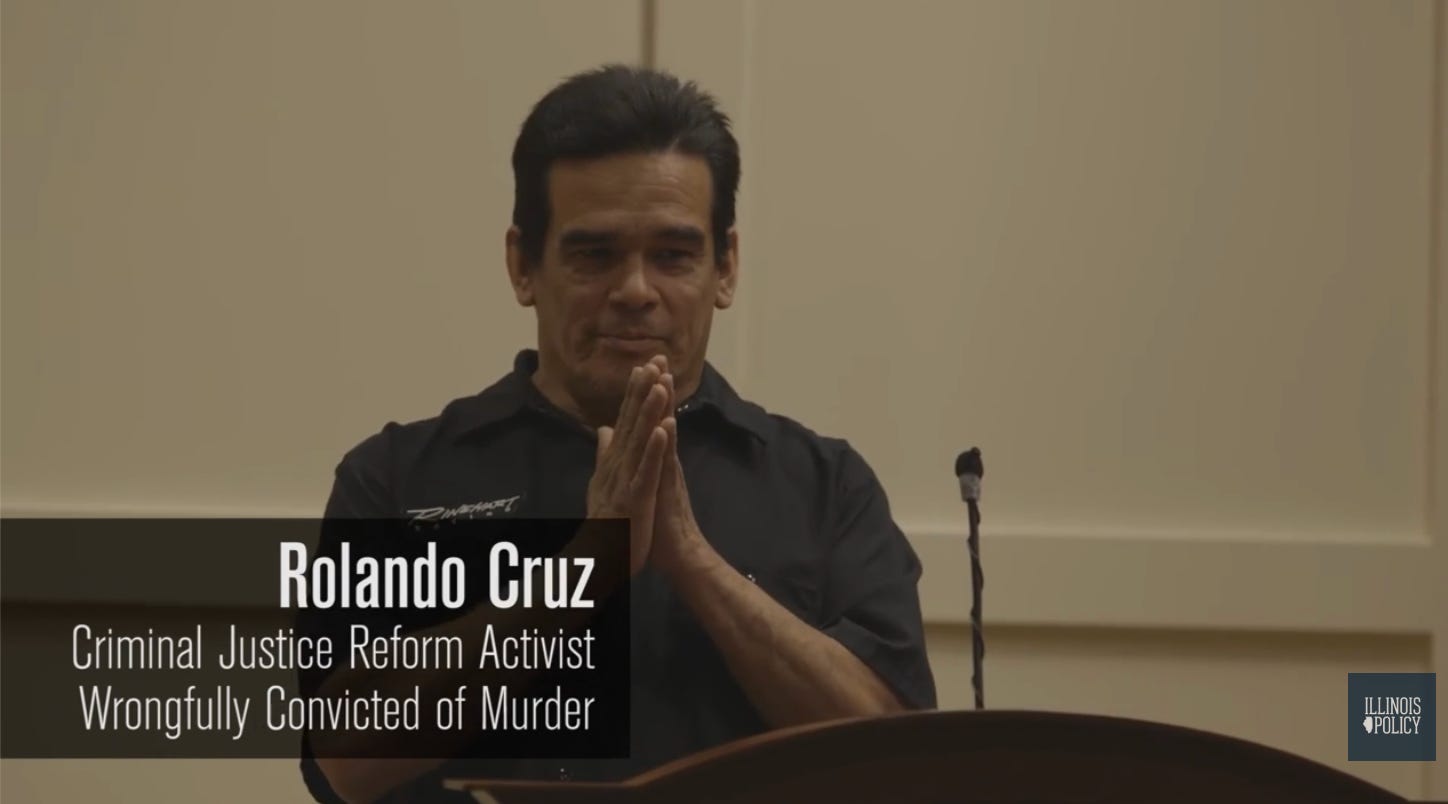

Tomorrow marks the 30-year anniversary of Rolando Cruz’s exoneration in the Nicarico murder case, after spending 12 years in prison, including nearly a decade on death row.

His wrongful conviction became one of several that prompted Illinois to impose a moratorium on executions in 2000 and ultimately become the 16th state to abolish the death penalty in 2011.

I was honored to work with Cruz and Aurora University in 2017 to host a rare conversation with him and several of the attorneys involved in this case. You can watch the full presentation here.

You mean to tell me that the exorbitant new water rates aren’t enough to bail out Chicago!? The City has a spending problem, not a revenue problem…but that’s how it goes with Socialists. It works until you run out of other people’s money.

In regards to vendors and bulk purchasing power, a portion of our neighborhood CPS school needed a paint job, so the principal selected someone from the approved vendor list, and moved forward. The amount paid that I heard was jaw-dropping. Regardless, who is negotiating vendor quotes, and why are school administrators making these decisions individually? I've worked for companies that paint schools for free on Volunteer Day.