This $830 million debt plan is Brandon Johnson’s parking meter deal

How Chicago’s governance structure, political culture, and a sympathetic City Council helped an unpopular mayor sell out the city’s future.

Chicago has a “pay later” political culture.

Staring down a budget deficit in the middle of the Great Recession? Sell off the next 75 years of parking meter proceeds and spend all that cash today. We’ll figure out how to replace that revenue later.

Want pension sweeteners for elected officials? No problem. That bill won’t come due until we’re all out of office anyway.

Find yourself the least popular politician in state history and need to pay for clout? Pass an $830 million bond deal with no payments on the principal for 20 years.

The latter is what Chicago Mayor Brandon Johnson did this week. Johnson’s bond deal is not an asset sale like Mayor Richard M. Daley’s parking meter deal. And it came under much more scrutiny from City Council in the lead-up to the vote (though not enough). But Johnson’s plan creates an enormous deferred debt obligation, which is its own kind of fiscal irresponsibility. And like Daley’s parking meters, he sold out Chicago’s future for short-term political gain.

It’s important for Chicagoans to understand how.

Johnson’s borrowing package

Just 6.6% of Chicagoans view Johnson favorably, according to recent polling. That makes him the most unpopular politician in Illinois history, worse than the low-water mark set by former Illinois Gov. Rod Blagojevich.

Yet more than half of Chicago City Council voted in favor of Johnson’s reckless $830 million bond deal on Wednesday, Feb. 27.

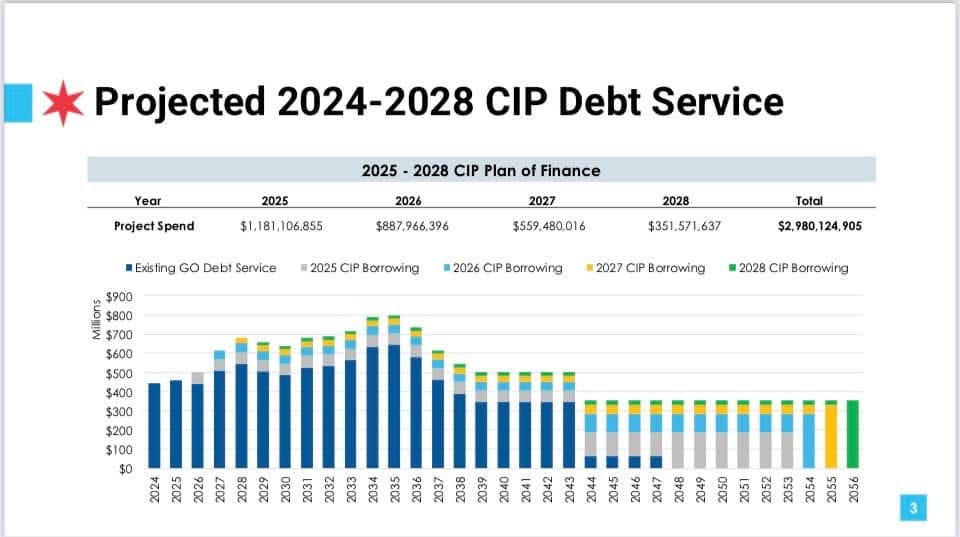

Under Johnson’s plan, the city makes no payments on the debt over the next two years (conveniently, the remainder of his term). And it makes no payments on the principal for 18 years after that. This backloaded schedule balloons the total cost of the debt deal to $2 billion.

Ahead of the vote, the Chicago Sun-Times, Chicago Tribune, and Crain’s editorial boards all described why it was irresponsible.

So how did such an unpopular mayor pass such a controversial deal? The play-by-play in City Council before that vote took place offers a few clues:

Ald. Brendan Reilly, 42nd Ward, made a motion to delay voting on Johnson’s borrowing package until May, to allow for more analysis and revision.

Then a motion was introduced to “lay” (kill) Reilly’s motion.

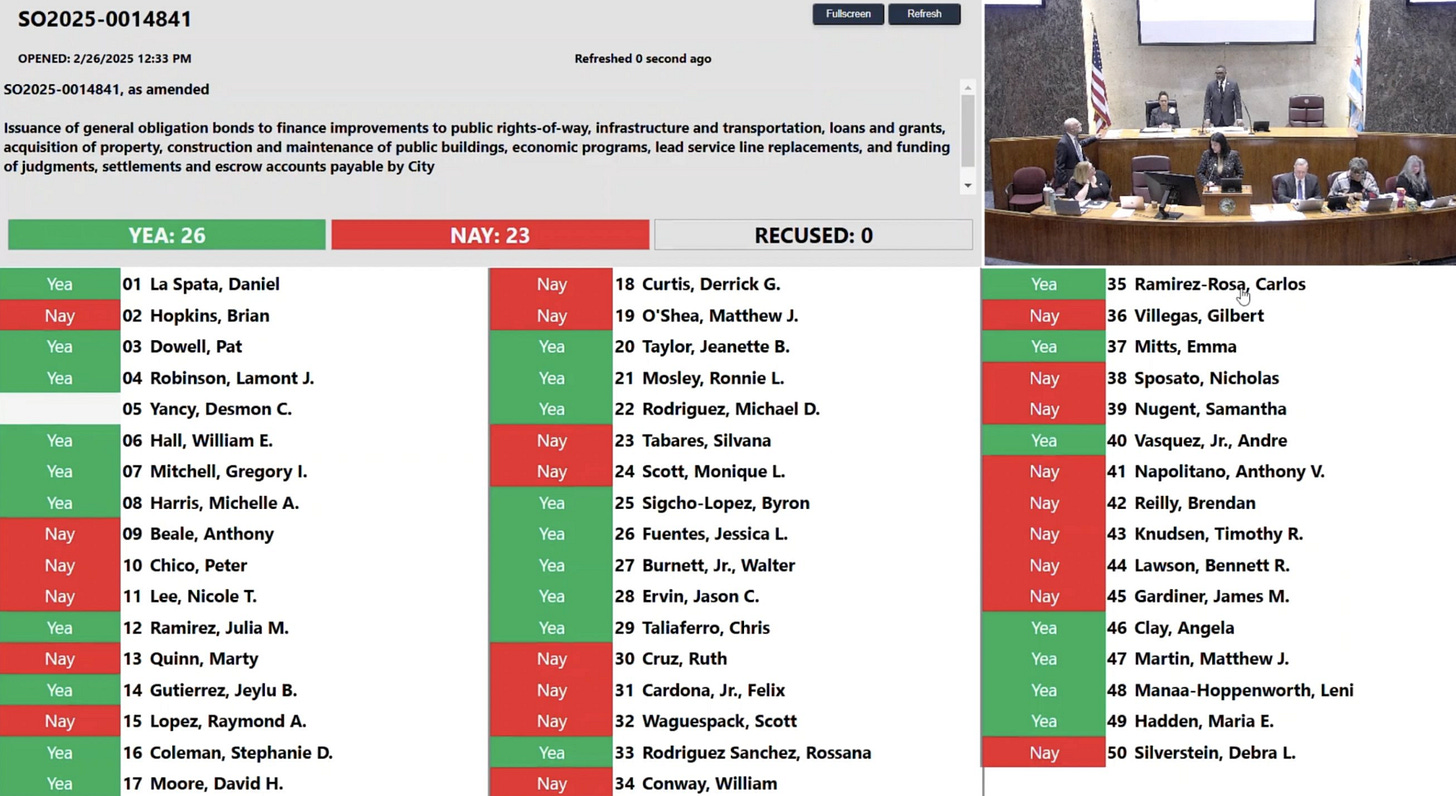

City Council voted on the motion to lay, and tied 25-25.

Johnson cast the tiebreaking vote in his favor, killing Reilly’s motion to delay the vote.

Council then took a vote on Johnson’s borrowing package, and approved it 26-23.

There are three main reasons why this deal passed.

1. Chicago’s governance structure

In New York or Los Angeles, the mayor could never break a tie vote on whether to delay consideration of an $830 million bond deal. Because the mayor isn’t even in the room.

In New York, a council speaker elected by council members presides over City Council. In LA, a council president elected by council members presides over City Council.

This structure was created by the city charters of New York and LA, which provide basic checks and balances in city government. Chicago is the largest American city without a city charter. It is also the largest American city where the mayor presides over Council and can cast a vote. This structure is outlined in Illinois state law, rather than a municipal charter.

Notably, 36th Ward Chicago Ald. Gil Villegas and Illinois State Rep. Kam Buckner, D-Chicago, have recently called on Springfield to allow a city charter for Chicago.

Buckner will be speaking at the Chicago Charter Symposium March 24 at Northwestern University’s Pritzker School of Law (register here), alongside the architects of the LA and New York city charters, Raphael Sonenshein and Eric Lane (podcast interview here).

2. The roll call

The vote to kill Reilly’s motion to delay tied 25-25. But the borrowing package passed with 26 votes. Why the difference?

Ald. Andre Vasquez, 40th Ward, voted with Reilly then voted with Johnson. So did Ald. David Moore, 17th Ward. And Ald. Desmon Yancy, 5th Ward, voted “present” on the borrowing deal.

Vasquez is my alderman. And I appreciate his willingness to speak openly about his thinking. Below is our conversation on this vote via text, lightly edited for clarity.

The Last Ward [TLW]: Anything you’d want to note on the motion to lay? You were the lone alder who voted with [Ald. Brendan] Reilly et al on that [motion], and then with Johnson on the borrowing plan.

Ald. Andre Vasquez [AV]: I think it was fair to propose a pause to see what could get more support. When Reilly motioned for it, I thought it was a fair thing to put up for a vote. The challenge I saw, which is why I landed on the vote I did, was that we had alders making the case to front load the debt service, but who ultimately wouldn’t vote to raise revenue to pay it when they time came to do so, and who wouldn’t seriously look at all departments to find efficiencies, when [the Chicago Police Department] is such a large expenditure. So it appeared to be a bit of political positioning, especially for our downtown colleagues, who would get infrastructure repairs no matter what, since it is downtown.

TLW: What do you mean by frontloading?

AV: Making the debt service payments on the principal sooner than 2045, in order to pay it off sooner. The 2045 made sense as that’s when the existing debt would be paid down by, making it more manageable to make the payment on the newer debt. This graph. Because the dark blue bar is paid off by 2045, you wouldn’t be stacking debt service on top of debt service, when the council doesn’t show the courage to vote on revenue to cover the cost. Also, technically we can’t codify the payment structure, so the payment structure was used as a way to make the Mayor look even worse, which is a political take more than a good government one.

TLW: Thanks. Thought that’s what you were referring to just didn’t want to assume. That debt wrapping argument reads similarly to what [Chicago CFO Jill] Jaworski was promoting. To me she was saying, in essence, we should steady the debt service in order to carry more debt. So if the issue was that those advocating for more responsible payment terms and a smaller scale of borrowing did not want to have the revenue discussion, I don’t follow how the same standard would not apply to Johnson and Jaworski’s plan. They were not giving ideas on how to pay for this 20 years from now.

AV: The challenge with Johnson and team is that they are so overall bad, that they have no idea how to negotiate budgets and they actually undercut themselves so much last year that we weren’t able to raise revenue. Jaworski’s logic appears to be that they don’t have the confidence that even they can raise the revenue, so they opt to keep it the same over the length of it all. All of the options are challenging ones. I’m trying my damndest to get this council to be more of an independent body that can actually do the homework to get more responsible decisions year over year. Today after the vote I was pretty frustrated and said that I was tired of the fact that we can’t have serious talks or hearings re: POBs [Pension Obligation Bonds].

TLW: Appreciate the context.

AV: Also, from talks with different stakeholders, it did seem as though this was more standard than presented, and the lack of trust and confidence in this Mayor did make this way more challenging. It is also fair that other prior Mayors should have had this level of scrutiny.

On the other side of this vote was South Side Ald. Anthony Beale, 9th Ward. I highly recommend watching Beale’s rebuke of Johnson’s deal. Below is the footage of his full speech from the floor of City Council and a transcript of select passages.

First of all, nobody’s ever said we don’t want an infrastructure bond. Nobody’s ever said that. But what we want is a bond that is responsible and feasible for the people of the city of Chicago. The fact that we are not paying on this bond for two years until after the next election poses a problem. The fact that we’re not paying on principal for 20 years and having a huge balloon payment is a problem. So I don’t know about you all. But I’m concerned about my kids having to foot this bill and my grandkids having to foot this bill. That’s what the problem is. The problem is the size of this infrastructure bond.

Now let me just digress just a little bit. Because I heard the same argument from the past administration about Invest South West. We’re going to invest everything on the South and West side of Chicago. We’re going to transform the South and the West side of Chicago. All the resources are going to the South and West side. How’s that working for you? How’s that working for you? How is all the infrastructure work that you all voted for on that last bond, how’s that working for you?Now I’m going to tell you. We’re all entitled to $1.5 million [in aldermanic menu money] to spread out. But when we are selling our vote for a couple of extra streets, it’s a problem.

When we have all the bond rating agencies, all the financial experts, all the financial people telling us this is a bad deal and for us to sit here and ignore that. That’s another problem. Now we’re supposed to listen to and get information from the administration, the CFO, the budget director. Well those are the same people that told us we will not get downgraded if the budget passes. Right? Right. Well we got downgraded. And they’re also telling us and warning us that if this bond passes we could potentially be downgraded again. And you all want to ignore that. C’mon y’all…

We are headed toward a cliff. Now yes we’ve made some bad decisions in the past. And if you’re not willing to admit we’ve made some bad decisions in the past, shame on you. But let me just tell you this, when you know better, you do better. And I happen to know better today than I did 25 years ago. Why? Because then we relied on the information that was given to us. Being new to politics you make bad decisions based on the information you are given. We’re not making those bad decisions anymore…

Again Mr. President this is a bad deal. I say we reduce it. We change the terms. And I guarantee you if you reduce it and change the terms you’ll get a lot more votes and a lot more people to buy into it. I’m one of them. Change the terms, change the amount to get more people on this bond – to get this work done. I’m not going to sit here and be afraid that I’m “not gon’ get”...Don’t be afraid when they tell you they’re going to pull your projects…I just encourage everybody in this body to understand we’re all for infrastructure. We’re all for improvement. We’re just not for bad policies moving forward. And I encourage everybody to vote no.

Beale is right.

3. Chicago’s “pay later” political culture

In research for our book The New Chicago Way: Lessons from Other Big Cities, my co-author Ed Bachrach was fortunate to interview the late Dick Ravitch. Ravitch is arguably the single person most responsible for saving New York City from bankruptcy in the 1970s, among many other achievements throughout his career in public service.

In Ravitch’s book So Much to Do, he wrote, “Cities need access to the credit markets for two reasons that are respectable and one that is not.”

The first respectable reason is to borrow in the short term to balance mismatches of revenue and spending within a given year, due to an economic shock, for example. The second respectable reason is to borrow in the long term to fund capital projects. The third reason, which is not respectable, is to cover operating deficits.

Johnson touted his borrowing plan as a pure capital project. But it contains plenty of Ravitch’s third reason for accessing the credit market.

For example, it funds $108 million in aldermanic menu money. Setting aside major problems with the practice of handing out menu money, that is a regular operating expense. It has no place in a long-term bond.

Taking out a long-term loan to spread the cost of a new bridge makes sense. Because Chicagoans 50 years from now will be using that bridge. But borrowing for today’s routine spending, like aldermanic menu money, street resurfacing ($102 million), light pole replacement ($18 million) and hazardous sidewalk repair ($9 million) is not a burden that should be dumped onto future generations.

Ald. Bill Conway, 34th Ward, made this point in a post about his three young children after Johnson’s bond deal passed.

What’s the big deal?

Chicago Ald. Walter Burnett, 27th Ward, summed up the three factors leading to this $830 million bond deal with one simple remark on the floor of City Council.

Chicago’s governance structure, the roll call, and our political culture.

All encapsulated in just 23 words.

"I don’t understand why everything we try to do the way it has been done over the years is such a big deal,” he said.

Therein lies the problem.

✶✶✶✶

Austin, every city, township, county needs a guy like you to ferret out the facts. Thank you for what you do!

Despite being run by idiots, Chicago is still a great place to live generally. I would love to see how much better it could be with continuous competent leadership but seems like a pipe dream.