How Democrats can unlock $100M+ for Chicago education without tax hikes

Democratic Colorado Gov. Jared Polis said he “would be crazy” to reject a new federal tax credit program. But Illinois leaders haven't committed.

A new program could unlock hundreds of millions of dollars for education in Chicago and across the state.

But it’s at risk of becoming a political football in Illinois, where special interests are trying to kill it before a single student can benefit.

In this week’s edition of The Last Ward, we break down that program, including my Chicago Tonight debate on whether Illinois should participate, and how you can take action to help bring it home.

How does it work?

The new program is called the Federal Scholarship Tax Credit, or FSTC. And it was established by the Educational Choice for Children Act, which Congress passed last year.

Here’s what you need to know about FSTC:

Americans can donate $1,700 to an eligible charity focusing on education and get $1,700 back on their federal tax bills.

These charities can cover education expenses for students attending public, private, or home schools.

Expenses include tutoring, special needs services, books, supplies, tuition and more.

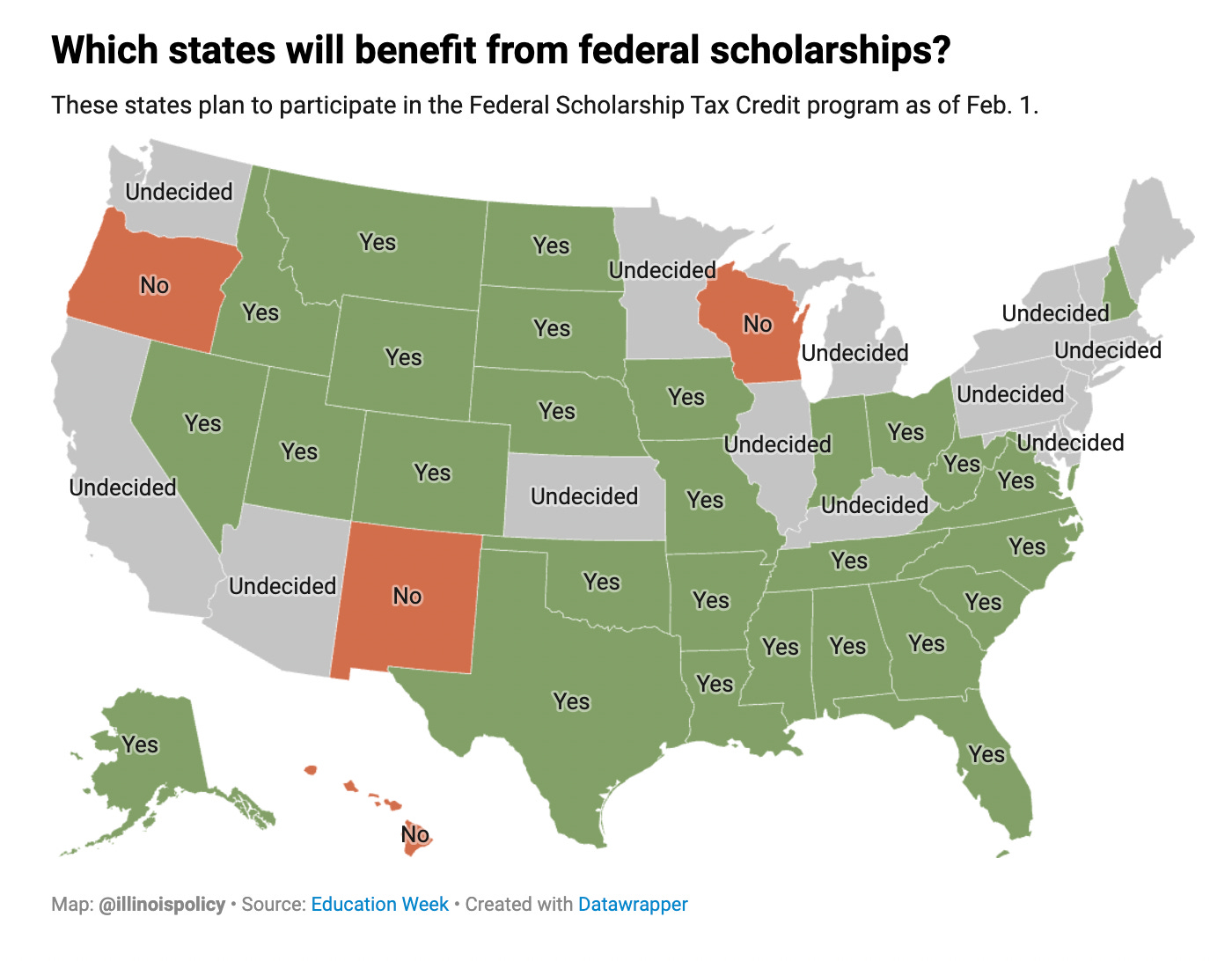

Most states (28 of 50) have already opted in to the program, hoping to hit the ground running when FSTC goes live in 2027.

If Illinois opts in, charities serving Illinois students can rake in donations that trigger the federal tax credit for donors.

If Illinois opts out, every Illinoisan will still be able to access the $1,700 tax credit. But they can only get it if they donate $1,700 to charities elsewhere.

In other words, dollars that could go toward helping Illinois students will instead flow to other states and Washington, D.C.

That’s why Democratic Colorado Gov. Jared Polis told the Colorado Sun he “would be crazy not to“ opt in to the program, and went deeper into his reasons for opting in on a recent podcast interview.

Polis on why he supports the program:

I think it’s great because it drives more donations to Colorado charities that serve kids. Some donors will choose charities that you and I might like. Others will choose some we don’t like. But there’s going to be a lot of good, because they have to use 90% of the money on direct benefits for kids…90% of the money has to go right out the door to kids in a variety of ways: after-school programs, tutoring, summer school, scholarships, all of those kinds of things.

On the funding model:

This encourages creativity. The feds are paying for it. It’s free money from our state perspective … it definitely will cause a big influx of funding for a lot of nonprofits that are doing great work with kids.

On filling in gaps for public schools:

Music programs, performing arts, all of those kinds of things often suffer from lack of resources because when districts have to make tough decisions they often say, well, we gotta do the academics and we don’t need to do the enrichment. Well the enrichment is very important. And this can help fund some of those activities outside of normal school hours.

Polis is right. Leaders in Chicago and Illinois should take note.

How this helps Chicago and Illinois

I joined Chicago Tonight for a debate on whether Illinois should opt in. You can watch it on YouTube and X.

My opponent was speaking on behalf of the League of Women Voters of Illinois, which signed a letter opposing the program alongside groups like the Illinois Federation of Teachers (currently led by Chicago Teachers Union President Stacy Davis Gates.)

Below are my three main points in favor of the program—none of which were rebutted in the debate or the letter.

1. Boosting the booster clubs

Chicago is home to more than 600 public schools, and hundreds of booster clubs and sister organizations to support them. There’s also a tapestry of nonprofits supporting the public school system as a whole. If Illinois opts in, many of these nonprofits will be able to offer donors a dollar-for-dollar federal tax credit in exchange for supporting their work. If 10,000 Chicagoans take advantage of the maximum $1,700 tax credit to fund these extra resources for public school kids, that’s $17 million, or $170 million over 10 years.

2. Less money for DC. More money for Chicago students.

The more you oppose the Trump White House, the more you should support this program. It allows a donor to take $1,700 that would otherwise go to Washington, D.C. and use it to support their local school community, including public schools. Ironically, many of the same groups that signed the letter demanding Pritzker opt out of the program have lamented the fact that Illinois sends more money to Washington than it gets back.1 The FSTC program helps recoup some of that money.

3. Protecting underprivileged students

The coalition letter demanding Gov. JB Pritzker opt out cited concerns about funding tuition for private schools that do not provide adequate protections for LGBTQ students, English Language Learners, and students with special needs.

There are two problems with this argument.

First, the concern specifically about LGBTQ students rings hollow given that Polis, a champion of opting in, is the first openly gay person elected governor in U.S. history.

Second, opting out would incentivize Illinoisans to send more charitable donations into states that lack the same protections Illinois students enjoy. Opting in means keeping more of those dollars here at home.

How to get it done

Illinois can opt in to the program in one of two ways.

The General Assembly passes a bill that Pritzker signs.

Pritzker issues an executive order.

The first option took a major step forward last week when state Sen. Adriane Johnson, D-Waukegan, introduced an opt-in bill (Senate Bill 3776).

If you support opting in, contact your state senator and tell them to support SB 3776 here.

Pritzker has not committed to opting in. But he has not committed to opting out, either.2

In the news

I joined Fox32 Chicago’s ChicagoLIVE program to discuss the Chicago Teachers Union’s recent audits controversy and Chicago’s drop in violent crime.

Reminder: I will be joining Paris Schutz and the Chicago Area Public Affairs Group at the Union League Club on Feb. 19 to discuss Illinois’ upcoming primary elections. Tickets here.

Also ironically, that’s due to the nature of progressive taxation. The Gold Coast neighborhood sends more money to City Hall than it gets back, for example.

Pritzker said the following when asked about the program: “Is this just a repeat of trying to take money out of public schools and move it into private schools, which is what the Trump administration generally speaking has been in favor of? Or is this something that could be useful? We just don’t know because there are no rules around it right now.” While it’s true that the Treasury Department is still finalizing some guidelines for the program, it’s not accurate to say there are no rules in place. The statutory language is clear on the following:

All the funding comes from donors. The program doesn’t use state or federal funds.

Donors can get an annual $1,700 tax credit regardless of whether their state opts into the program.

Qualified expenses include tutoring, special needs services, books, supplies, tuition and more for students at public, private or home schools.

Great article! I just had to restack. I only hope he can make a better decision on this opportunity help kids than he did with ‘Invest in Kids’.

I also realized that I wasn’t a paid member so I solved that problem.

In one place you refer to a federal tax "deduction" which I think isn't correct. It's a tax _credit_, right? (Those being different things having very different practical impacts on individual taxpayers.)